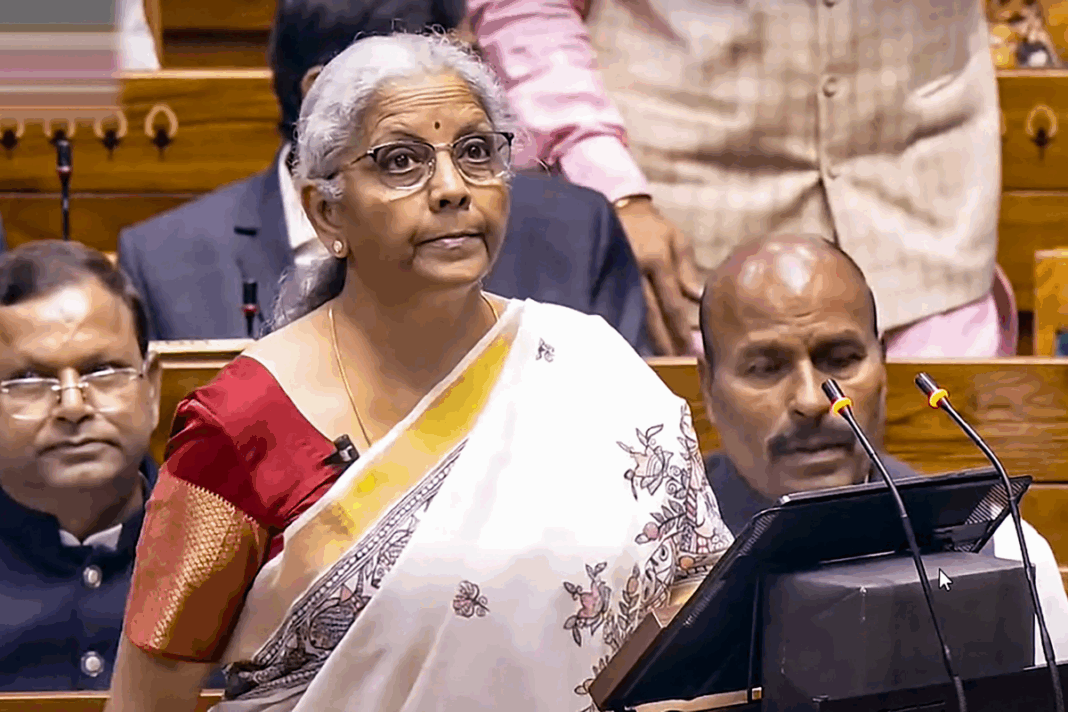

High Hopes from Union Budget 2026, As India looks ahead to the Union Budget 2026, expectations from Finance Minister Nirmala Sitharaman are running high. With inflation concerns, rising education costs, and a growing push toward green mobility, the common man is hoping for practical relief rather than symbolic announcements. From income tax tweaks to support for students and EV buyers, Budget 2026 could play a key role in shaping household finances in the coming year.

DON'T MISS

Income Tax Relief: More Money in Hand?

Income tax changes are expected to be the biggest talking point. The government may continue strengthening the new tax regime by simplifying slabs and possibly raising the basic exemption limit. Middle-class salaried taxpayers are looking for reduced tax liability and easier compliance.

Any rationalisation of slabs or enhancement of standard deductions could directly increase disposable income, offering relief amid rising living costs.

Education Loans: Support for Aspirational India

With higher education becoming increasingly expensive, education loan relief is another area under focus. Budget 2026 may consider expanding tax benefits on interest paid under existing provisions or improving repayment flexibility.

Such measures would benefit students and parents alike, especially those funding professional or overseas education through loans.

EV Adoption: Boosting Affordable Green Mobility

The push for electric vehicle adoption is expected to continue as part of India’s clean energy goals. Possible announcements include tax incentives for EV buyers, support for charging infrastructure, or benefits for domestic EV manufacturing.

For the common man, this could mean lower upfront costs and improved convenience, making EVs a viable everyday choice.

Beyond Sectors: Jobs, Inflation, and Growth

Apart from direct benefits, Budget 2026 may focus on job creation, MSME support, and infrastructure spending. These measures indirectly strengthen household income and economic stability.