New GST Rates: The 4th of September 2025 in New Delhi – Prime Minister Narendra Modi gave the country a huge Diwali gift when the GST Council, led by Finance Minister Nirmala Sitharaman, approved “Next-Generation GST Reforms” on September 3, 2025. This was a historic decision. These changes were announced as part of Modi’s Independence Day vision. They will take effect on September 22, 2025, and will completely change India’s tax system. They will bring about a new age of affordability, ease of living, and economic empowerment through the Aatmanirbhar Bharat initiative.

Easy Tax Slabs for a New Era

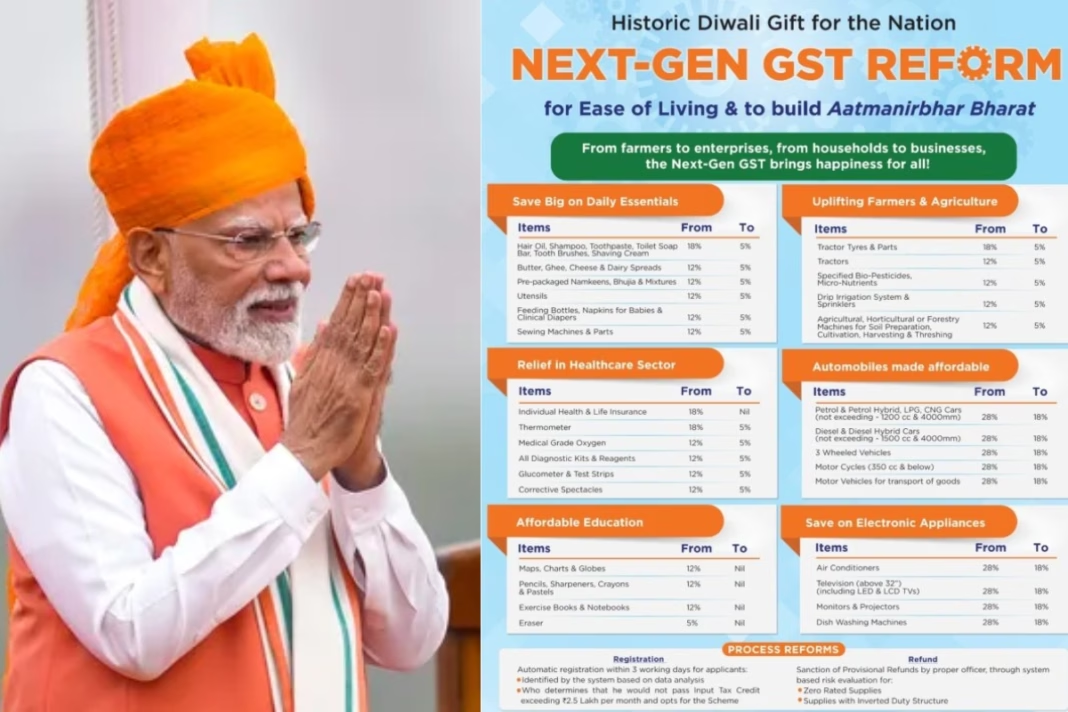

The new GST structure simplifies tax slabs to 5% and 18%, with a 40% rate for sin goods like tobacco and luxury goods. This is a big change from the old system, which had multiple levels. One important change is that health and life insurance for individuals are no longer subject to the 18% GST. This is good news for millions of customers. With this move and lower prices on basic goods, September 22 will be a new day for both Indian consumers and companies. Daily necessities like soap, toothpaste, hair oil, and packed food, which is now taxed at 5% (down from 12–18%), will all get cheaper. Medicines will also get cheaper in the same way.

A boost for farming and consumer goods

GST on tractor tires, pesticides, and drip irrigation systems has gone down from 12% to 5%, which is good for the agricultural industry and helps farmers make more money. With rates going down from 28% to 18% on gasoline, diesel, hybrid, LPG, and CNG cars, as well as motorcycles and vehicles that carry goods, the auto industry is picking up speed. Rates on electronics like air conditioners, TVs, dishwashers, and freezers will also drop from 28% to 18%, which means big savings for the holiday season. Supplies for schools, like pencils, crayons, and exercise books, will no longer be subject to GST. This will make learning easier for more people.

Streamlining Business Processes

Process changes make the deal even better by automating registration for businesses with a monthly turnover of more than ₹2.5 lakh, making refunds easier, and supporting zero-rated supplies and inverted tax structures. PM Modi said that these changes would make GST “better and simpler.” He said that the goal was to lower costs for MSMEs, small traders, and the middle class while also boosting the economy.

Different Responses and a Look at the Budget

Even though people are hopeful, the changes have gotten mixed reactions. Supporters praise the focus on consumers, but critics point out the bad timing, such as Rahul Gandhi’s 2016 call for an 18% GST cap. The expected loss of ₹480 billion ($5.5 billion) in revenue is a cause for worry for the government’s finances, but they expect a recovery driven by consumer spending. India is trying to fight global trade pressures like U.S. tariffs. This change is a plan to increase demand and strength in India. India is about to have a better, cheaper future after September 22.