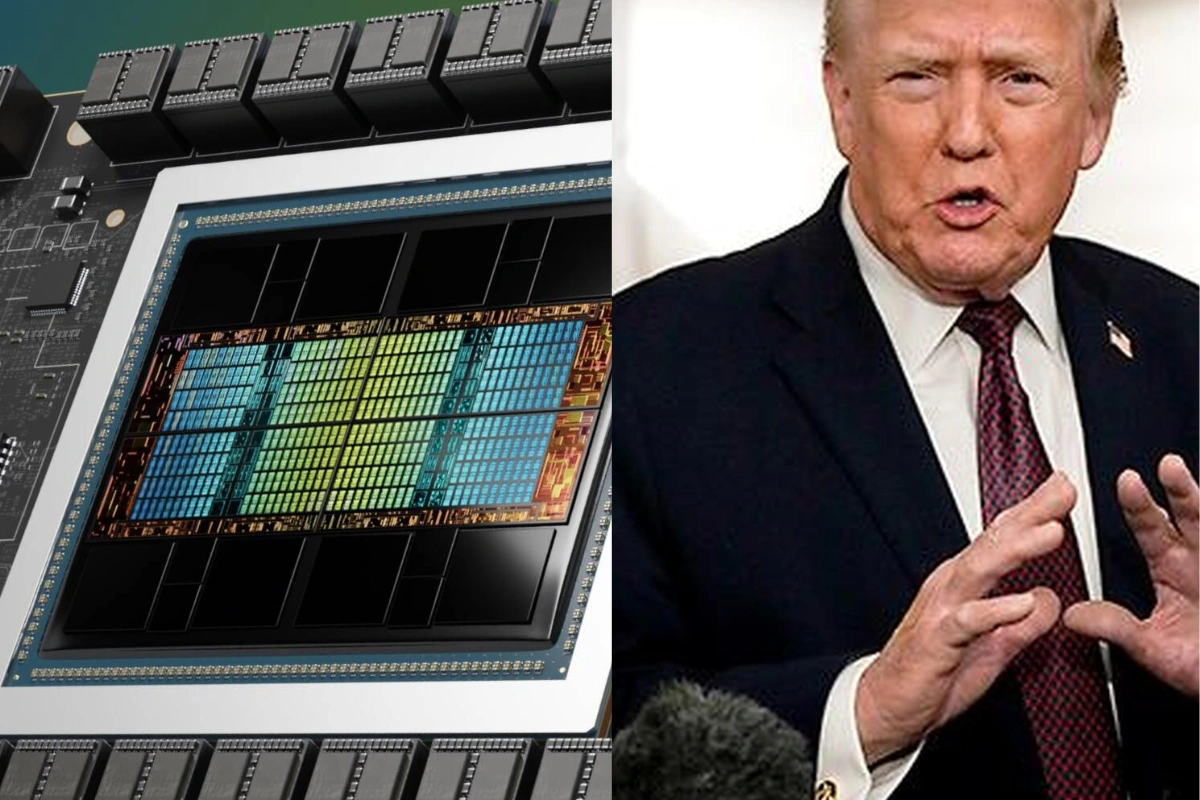

Nvidia Chips for AI: Donald Trump has imposed a tariff 25 percent on specific artificial intelligence (AI) chips such as the Nvidia H200 AI processor and a similar semiconductor from AMD called the MI325X.

Citing critical national security threats, Trump made the decision after an investigation spanning nine months under Section 232 of the Trade Expansion Act of 1962.

The tariff proclamation said the United States of America presently fully manufactures only about 10 percent of the chips it requires that makes it excessively reliant on foreign supply chains. It added that this reliance is a considerable national and economic security risk.

DON'T MISS

Tariff Exemptions-Nvidia Chips for AI

In a fact sheet, the US White House said that the tariffs would not be applied to derivative devices and chips that are imported for US datacentres, non-datacentre consumer applications, start-ups, US public sector applications and non-datacentre civil industrial applications.

Many industry experts believe that this move by the Trump administration would turbocharge domestic chip fabs by exempting US supply chain imports. It was added that the Taiwan-made GPUs by Nvidia would face import duties before global resale, including to China.

Some believe that Trump may impose broader and additional tariffs on imports of semiconductors as well as their derivative products. This could be done to incentivize manufacturing in the domestic sector.

Impact on Global AI Markets

It is believed that while AMD would eye gains, the Ascend chips of Huawei could possibly feast on the retaliatory hunger of China. This could soon translate to CHIPS Act 2.0 funding explosion, luring GlobalFoundries and Intel to build stateside. However, there may be a possible downside. A bifurcated artificial intelligence world featuring premium versus cheap Asian alternatives can stifle global collaboration.

There may be some chances of a market recovery by Q2 if China blinks but given the counter-threats of China (like rare earth curbs), this does not seem a possibility in the near future.