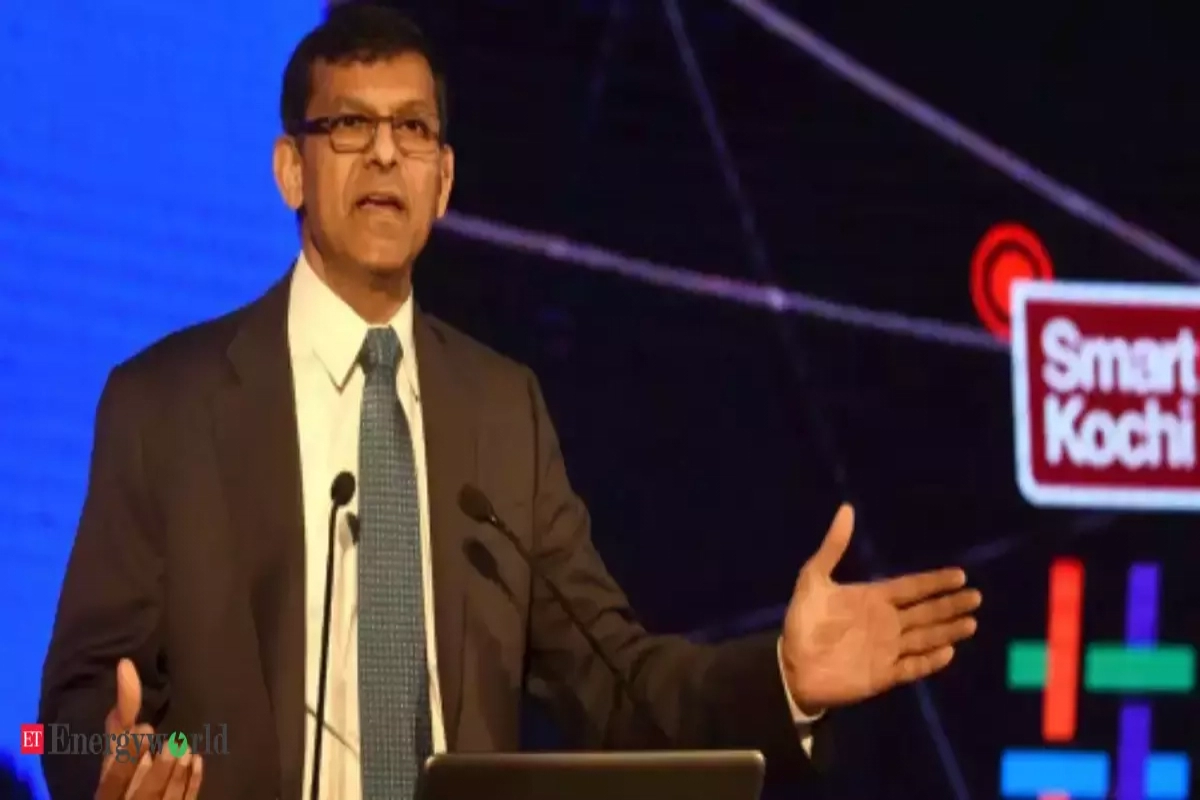

The four Mauritius based funds such as Elara India Opportunities Fund, Cresta Fund, Albula Investment Fund and APMS fund have been the cloud for last couple of years that they might be shell companies. Former RBI Governor Raghuram Rajan has asked SEBY as to it is yet to look into the ownership of four Mauritius based funds who are said to have parked 90 percent of their $ 6.9 billion in Adani Group stocks. He has also asked why does the market regulator need the help of investigating agencies for this.

Rahuram Rajan asks why SEBI is yet to look into the ownership of Mauritius based funds

These funds came to notice in January when Hindenburg Reseach, a US short seller had alleged that Adani Group used offshore shell companies to inflate stock prices.

Rajan asked,

“The issue is of reducing non-transparent links between government and business, and of letting, indeed encouraging, regulators do their job. Why has SEBI not yet got to the bottom of the ownership of those Mauritius funds which have been holding and trading Adani stock? Does it need help from the investigative agencies?,”

The Mauritius based funds Cresta, Albula and Elara have been subject to atleast one probe for alleged round-tipping. Because their funds are registered in tax haven Mauritius, their ownership structure is opaque.

Also Read: Manish Sisodia arrest: Nine leaders write to PM Modi over ‘misuse of Central agencies’

Let there be level playing field for everyone and no single promoter becomes all powerful

Regarding what measures the government should take to enhance and improve the oversight of private family companies to address worries after the Hindenburg allegations. Raghuram Rajan stated that he does not think the issue is of mere oversight over private companies. He also reiterated that private businesses and family enterprises should be encouraged, there must be a level playing field for everyone, where no single promoter becomes all powerful.

Rajan stated,

“It does not serve the country well when certain families are seen as having privileged access to policymakers. Let businesses flourish based on their acumen, not on their connections,”

The Supreme Court recently has set up a six member committee headed by former Supreme Court judge Justice AM Sapre to look into the protection of Indian investors. The Apex court has also asked the SEBI (Securities and Exchange Board of India) to probe within two months allegations of stock manipulation by the Adani group and any other lapses in regulatory disclosures.

It was only last month that SEBI told the court that it was investigating Hindenburg allegations and the Supreme Court had asked it to complete the investigation within two months.

Also Read: CBI questions ex-Bihar CM Rabri Devi at her residence in land for jobs scam case

Keep watching our YouTube Channel ‘DNP INDIA’. Also, please subscribe and follow us on FACEBOOK, INSTAGRAM, and TWITTER