The recent interim union budget, unlike previous budgets, went without any thrills and frills. Presenting a record sixth straight budget, equaling the record of Morarji Desai, FM Sitharaman outlined performance on governance and development. Contrary to popular expectations before 2024 mega election, there was no big announcement of either welfare schemes or any changes in direct and indirect taxes were made. In her shortest budget speech ever, the FM showcased inclusive schemes and policies of the Modi government in the last 10 years. But it appears that election related ‘populist’ promises will follow soon.

Looking at the current budget in the context of political business cycle, the budget aims to harness the economic and political momentum for stability and continuity. From Panchayat to general election, not only poll promises but government and private decisions on policy or investment have become overtly pro-cyclical. Shortening the fanfare of the budget is a natural process considering politicking in India is round the year activity. A democratic government of 10 years seeks another mandate based on its performance and achievements.

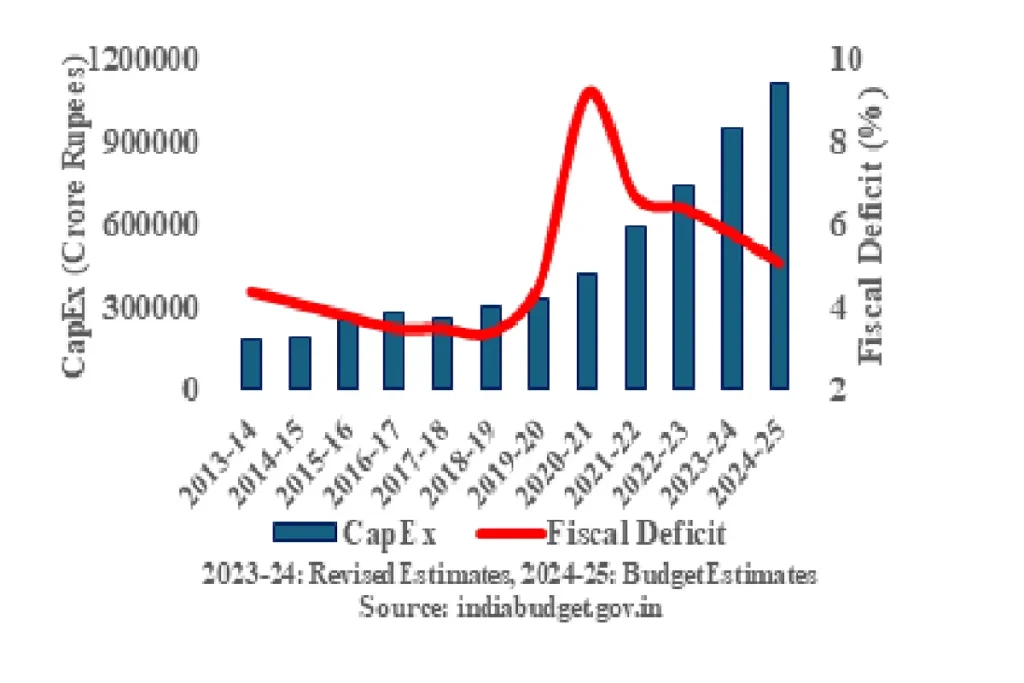

The budget speech of the FM and interviews afterwards suggest that long term goals take precedence to shape and guide the future targets of developed India by 2047. Focus on capital expenditure remains the mainstay of the budget with an increase of over 11 percent. Five times increase in the capex over 10 years is now one of the defining features of the present regime. Digital, physical and social infrastructure spending are major vehicle of growth and employment. Adding half-hearted GST with infrastructure boom is another milestone in unifying the country as one market. However, growth trajectory of indirect tax collections should avoid the secular trend.

Fiscal discipline and conservatism of the Modi government continues to enamor and amuse to observers on the left and right. Against the popular perception, the FM announced revised fiscal deficit at 5.8 percent for 2023-24 against the budget estimate of 5.9 percent. From a sharp rise to 9.2 percent during the pandemic, the government appears well poised to achieve fiscal deficit target of 4.5 percent by 2025-26. Additionally, low external debt to finance fiscal deficit remains high point of India’s budget management. Going against the trend and prescriptions of the Western experts, India has fared well in handling pandemic and post pandemic global challenges with finetuning of fiscal and monetary policies.

Inflation remains a major concern but is not out of bounds with January 2024 inflation rate going down to 5.1 percent. Proactive inflation management has kept inflation within the policy band. Food and energy constitute major part for ordinary food basket and coincidentally these two have faced serious supply side problems due to manmade and natural causes in recent times. Supply chain disruptions further exacerbate the problem for the Indian consumers; however, it also opens door of opportunities for Indian manufacturing. In the hindsight, the success of production linked incentive (PLI) schemes in key sectors like electronics demand broadening and fine tuning of the scheme to take advantage of the some of the supply chain moving away from China. The path of developed India cannot be paved with services led growth alone, manufacturing must rise to the occasion.

DON'T MISS

Any discussion on the budget or contemporary Indian economy cannot remain oblivious to the global macroeconomic scenarios. Since the outbreak of the pandemic, the world economy has been going through high inflation, high interest rates, low growth, very high public debt and low trade growth amid climate challenges. The present government must get credit in steering Indian economy away from the crisis of food, fertilizer, fuel, and finances. Securing the steady flow of oil & gas at discounted rates is a masterclass in negotiation and diplomacy and a tale to tell in the future. It is no surprise that reordering of the world order was mentioned in the interim budget speech of the FM.

The dramatic fall in the headcount ratio (HCR) capturing the multi-dimensional poverty is phenomenal if figures presented are further verified to be true. Demonetization, the GST and pandemic had severely dented the economic activities and employment. There was a widespread fear of increasing poverty during pandemic but claims of falling HCR favors government approach and policies including free food to 800 million along with direct benefit transfers (DBTs) under various schemes. The government has remarkably saved 2.7 lakh through DBTs by checking leakages and efficiency gains.

Amid domestic and global challenges, the Indian economy appears buoyant. From fragile five to the fastest growing major economy, India has traversed long distance in 10 years. Economic growth and welfare programs translating into improvement in the standard of living of ordinary citizens is a quintessential feature of development under the current government. During the election year, widespread hope and expectations of stability and continuity define the interim budget and popular sentiments.

By Dr Manish Kumar, Assistant Professor, Department of Economics, SRM University AP