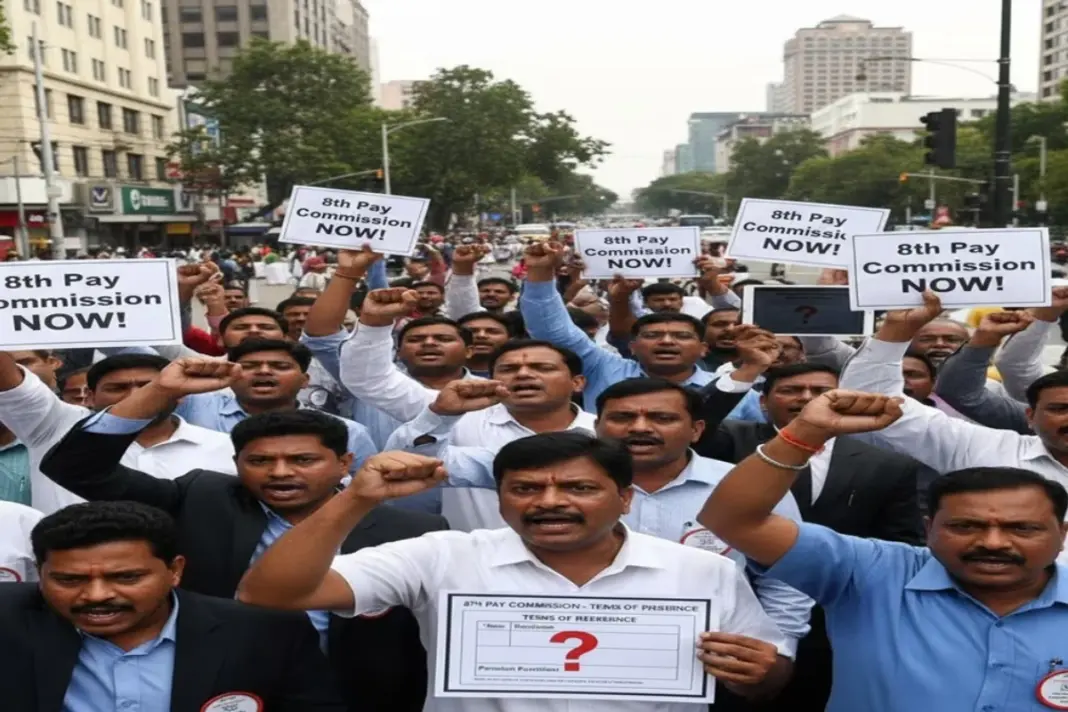

8th Pay Commission: Formally constituted in November 2025, the 8th Pay Commission promises happy time for over 50 lakh central government employees and 65 lakh pensioners. If this is not all, the 8th pay commission is also expected to push up retail, consumer goods and financial stocks in FY 26-27.

DON'T MISS

Key Expectations from the 8th Pay Commission

Led by Justice Ranjana Desai, the panel has an 18-month deadline to recommend revisions, with implementation eyed from January 2026 despite Finance Ministry clarifications of no active proposal yet. Fitment factor projections range from 1.83 to 2.46 that implied an increase of 30-40 salary after resetting Dearness Allowance (currently 55-58%) to zero, alongside arrears payouts estimated at Rs 3.7-3.9 lakh crore.

What to Expect?

Higher disposable income for more than one crore beneficiaries who are primarily concentrated in tier 2 and 3 cities of India is expected to drive demand for footwear, retail, premium FMCG products and quick-service restaurants. Thanks to this, retailers now stand to gain big time from volume growth in discretionary spends, which will potentially offset inflation pressures from arrears.

Banks in India are likely to be a beneficiary from liquidity surges as pensions and salaries rise. PSU players such as State Bank of India, Canara Bank and private banks such as HDFC and ICICI Bank are likely to see deposit inflows and loan demands.

On the other hand, insurance firms such as SBI Life and HDFC Life may capture annuity and guaranteed-return deployments from lump-sum arrears. Credit card usage may spike for rewards on elevated spending, which may favour issuers such as SBI Cards.

A higher fitment factor ensures sharper real-wage growth, which will attract institutional investors via improved earnings in the economy. Sectors such as real estate, autos and durables are likely to join the rally.