Gold Silver Prices: The prices of gold and silver have been reaching record highs with every passing day. The primary reason behind this exponential surge is the fact that investors are piling their money into safe haven assets as global political uncertainty amid the possible US-Iran war and the ongoing Israel-Gaza and Russia-Ukraine conflicts.

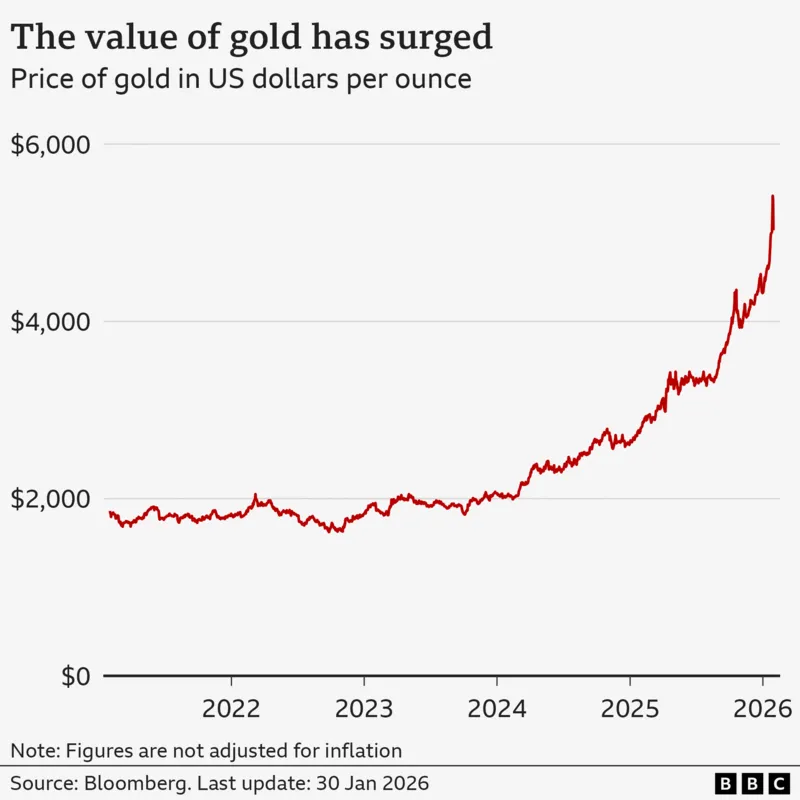

On Monday, the yellow metal (gold) went past the $5,000 per ounce mark for the first time in global history before hitting $5,500.

Investment Decisions Primarily Influenced By Trump Madness

Global trade equations have been left upset by tariffs imposed by United States President Donald Trump. His unequivocal obsession for Denmark’s Greenland and even Canada’s Alberta are not hidden from the world.

His recent capture of Venezuelan President Nicolas Maduro and his wife and threats to Iran, Cuba, Mexico and the European bloc have been worrying investors for a while driving the gold and silver rallies, according to Emma Wall, chief investment strategist at Hargreaves Lansdown.

Wall added that the fresh rounds of friction between Canada, China and the United States, shutdown risks in USA, unease around the Middle East and Europe have added to appeal of the yellow metal.

Hamad Hussain, an economist at Capital Economics, remarked that the precious metal is in the spotlight primarily because everyone feels gold as a safe investment.

DON'T MISS

Gold Silver Prices-The India Factor

The Indian Economic Survey 2025-26 highlighted that the prices of gold and silver are likely to stay at elevated levels amid global uncertainties that have been persisting for too long now.

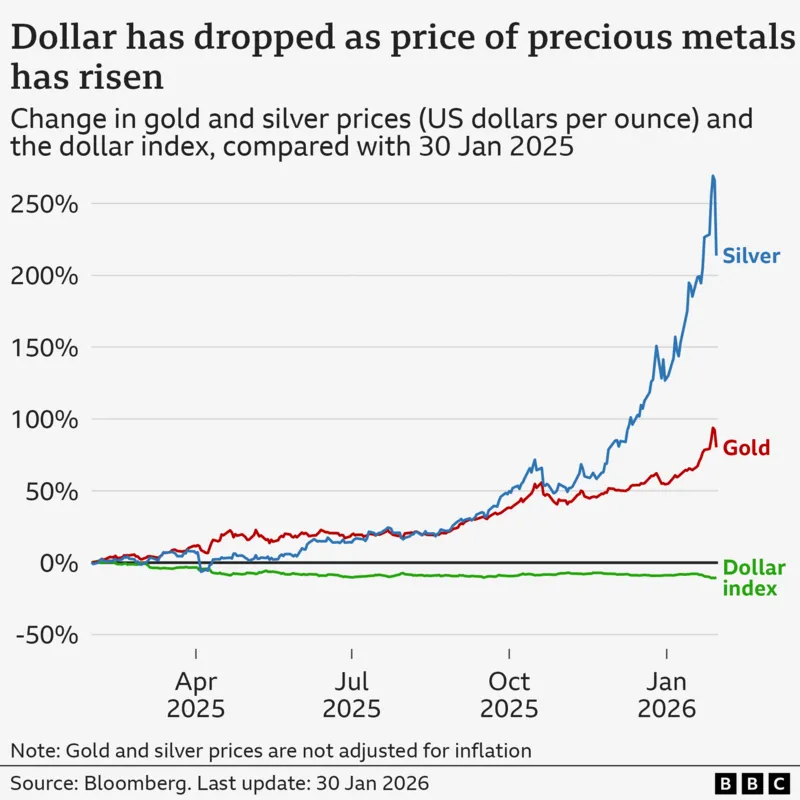

In the month of January 2026, the prices of gold and silver in terms of Indian Rupees soar approximately 24 and 58 percent, respectively. Interestingly, silver and gold posted absolute returns of 167 and 75 percent, respectively, in 2025.

Factors Behind Surge In Gold Silver Prices

A series of factors are driving the surge in the prices of gold and silver. These include:

- Geo-economic fragmentation risk

- Possibility of military action by USA in Iran

- Weakening of the United States dollar

- Geopolitical and trade wars

- A possible partial US shutdown in February

- Rising global debt

- Growing fears of a recession in the United States

- Large-scale purchases of silver and gold by central banks

Which Is a Better Buying Decision-Gold or Silver?

Silver is procyclical and gold is countercyclical. A safe haven, gold is considered a portfolio diversifier, a hedge and a store of value during periods of macroeconomic and geopolitical uncertainty. In contrast, silver is closely associated with economic expansion and industrial growth.

The Future Ahead

Daniela Hathorn, a senior market analyst at Capital.com, remarked that gold and silver are signalling a trust re-pricing (in institutions, currencies and the stability of the post-cold war economic order) and not just short-term market stress.

The demand and prices of gold and silver are not expected to cool down anytime soon. A rare alignment of structural, geopolitical and macroeconomic forces would keep the prices soaring. Also, central banks are not shying away from aggressively diversifying from US Treasuries.