Fixed Deposit Interest Rate: As opposed to erratic market-linked investments, fixed deposits provide capital preservation. It appeals to risk-averse people and senior persons because of this attribute. You will receive payment for your investment at a predetermined interest rate when the FD matures.

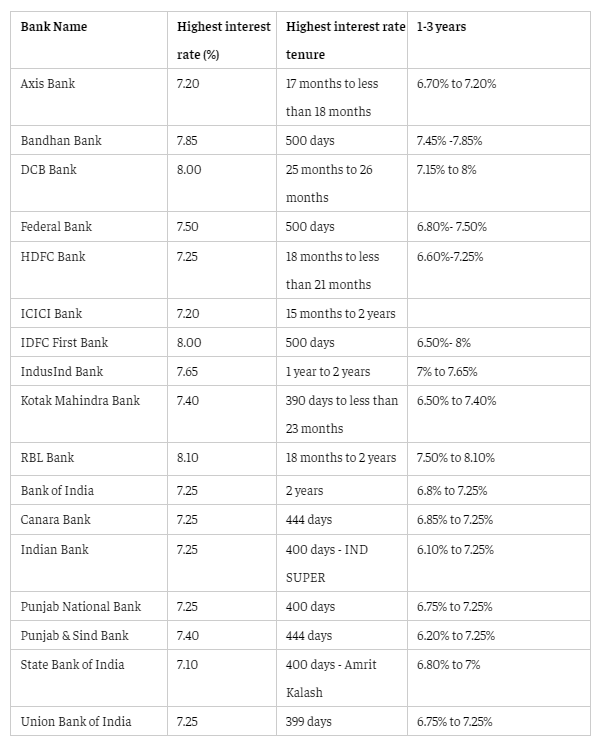

Top Banks Offering Highest Interest Rates

Investing in Fixed Deposits

With an FD, you can invest a certain amount of money for a preset period of time at a fixed interest rate. The interest rate on a fixed deposit may vary depending on the conditions of each financial institution. There are options for fixed deposits with maturities varying from one week to ten years.

DON'T MISS

You divide your overall investment amount among numerous FDs with varying maturities when you use the FD laddering approach. You can build a ladder of FDs with varying maturities instead of putting all of your money into one FD.

Understanding Fixed Deposit Laddering Strategy

According to the ICICI Bank, “A Fixed Deposit Laddering Strategy is an investment technique that involves dividing a lump sum of money into multiple FDs, each with varying maturities. Instead of investing the entire amount in a single deposit, investors allocate it across several deposits with staggered maturity periods. The primary objective of this approach is to strike a balance between earning steady returns and maintaining access to funds at regular intervals.”

Taxation of FD Interest Income

Your FD interest income is subject to full taxation. The interest you earn is deducted from your overall tax obligation. Because interest earned on FD is considered “income from other sources,” Tax Deducted at Source, or TDS, is applied.

The same moment your bank credits your account with interest revenue is when the TDS is deducted. This is the tax deducted at source (TDS) rate on interest from fixed deposits that is higher than Rs. 40,000 for a fiscal year. The TDS threshold for senior citizens (60 years of age or older) is Rs. 50,000. The Income Tax Department has a system in place called Tax Deducted at Source (TDS) to collect taxes during specific transactions.