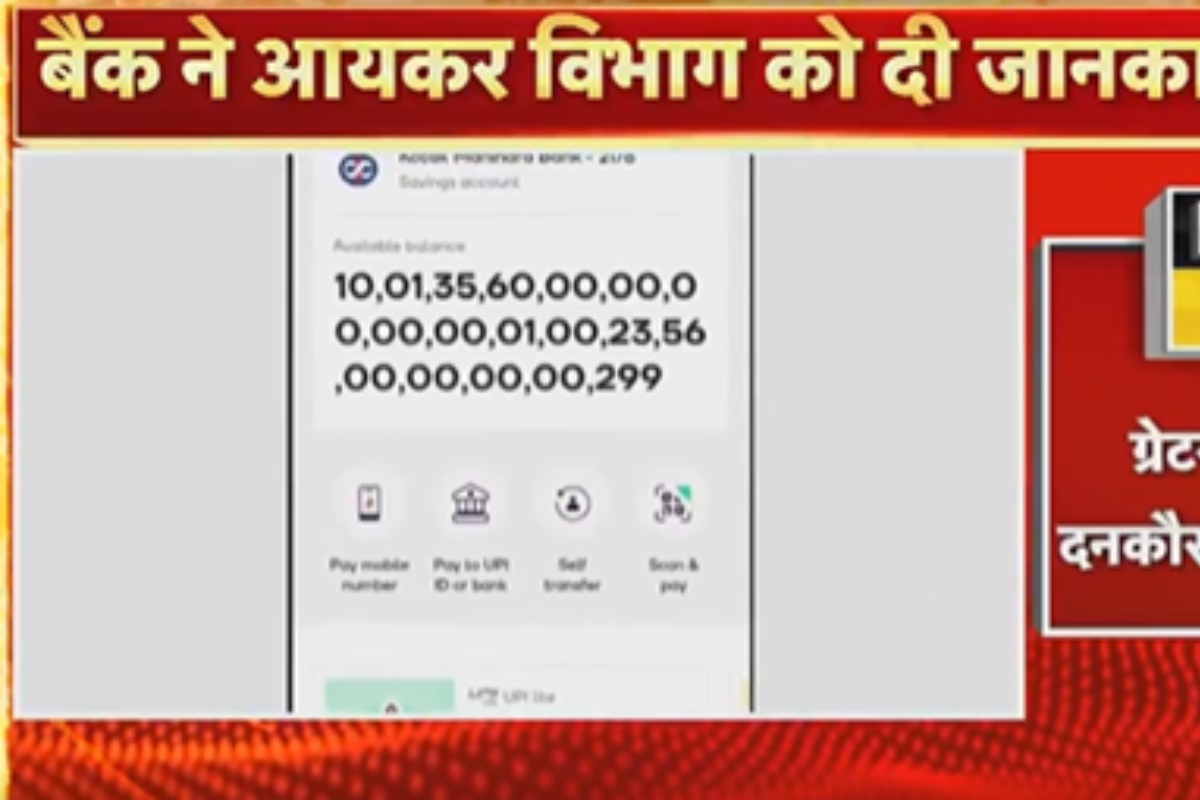

Viral News: A Greater Noida resident was left speechless after discovering a jaw-dropping ₹1.35 lakh crore credited to his bank account overnight. The massive 36-digit figure appeared without warning, instantly turning his ordinary day into a whirlwind of shock and disbelief. Initially thinking it was a technical glitch, the man rechecked his balance multiple times, only to confirm the staggering amount was real—at least on screen.

The bizarre incident quickly spread across social media, leaving netizens stunned and amused. While the man reported the issue to the authorities, questions flooded in, Was it a banking error? A digital bug? Or something bigger?

Greater Noida Man Shocked by ₹1.35 Lakh Cr Transfer

A resident in Greater Noida logged into his banking app to find ₹1.35 Lakh Crore mysteriously credited overnight. Ghar ke Kalesh shared this startling event in a viral news post on X, sparking widespread amazement. The man immediately contacted his bank after seeing the 36-digit number, convinced it was a display error.

Bank officials, equally surprised, froze his account and opened an internal inquiry. Early bank statements hint at a system anomaly rather than wrongdoing. Cybercrime units now assist the bank to ensure that no breach or fraud occurs. This bizarre glitch highlights how even trusted core banking systems can face unexpected failures.

DON'T MISS

Income Tax Department Probes Shocking Viral News Incident

Income Tax officers have begun a preliminary review of this viral news incident despite no formal complaint having been filed yet. They plan to verify whether the credited amount triggers tax liabilities or reporting requirements under Indian law. Experts suggest the department could issue notices under Section 133B to gather detailed account information swiftly.

Tax authorities might also seek cooperation from the bank’s compliance team to clarify the source of the entry. Meanwhile, individuals are advised to maintain clear records and inform their chartered accountants instantly if similar anomalies occur. Transparent communication and prompt disclosures can help avoid penalties if the glitch leads to false taxable events.

Digital Glitch or Fraud? Experts Investigate Unusual Entry

Cybersecurity specialists have weighed in following this viral news saga, but remain cautious without official data. Some experts suspect a software bug in the bank’s core processing system rather than a malicious hack. Others warn that sophisticated cybercriminals could manipulate transaction logs to mask fraud. Banks typically employ multi-layered defenses such as anomaly detection and two-factor authentication to prevent such breaches.

Regulators may now require institutions to stress-test their systems under extreme scenarios. Customers are urged to update their apps regularly and monitor account statements daily. Until investigators release their findings, the true cause of this 36-digit error remains unconfirmed.

This viral news incident underscores the urgent need for stronger digital banking safeguards against glitches and fraud. Authorities promise a full investigation soon.

Note: This Article has been based on the information provided in this viral video/post. DNP India doesn’t endorse, subscribe to, or verify the claims.