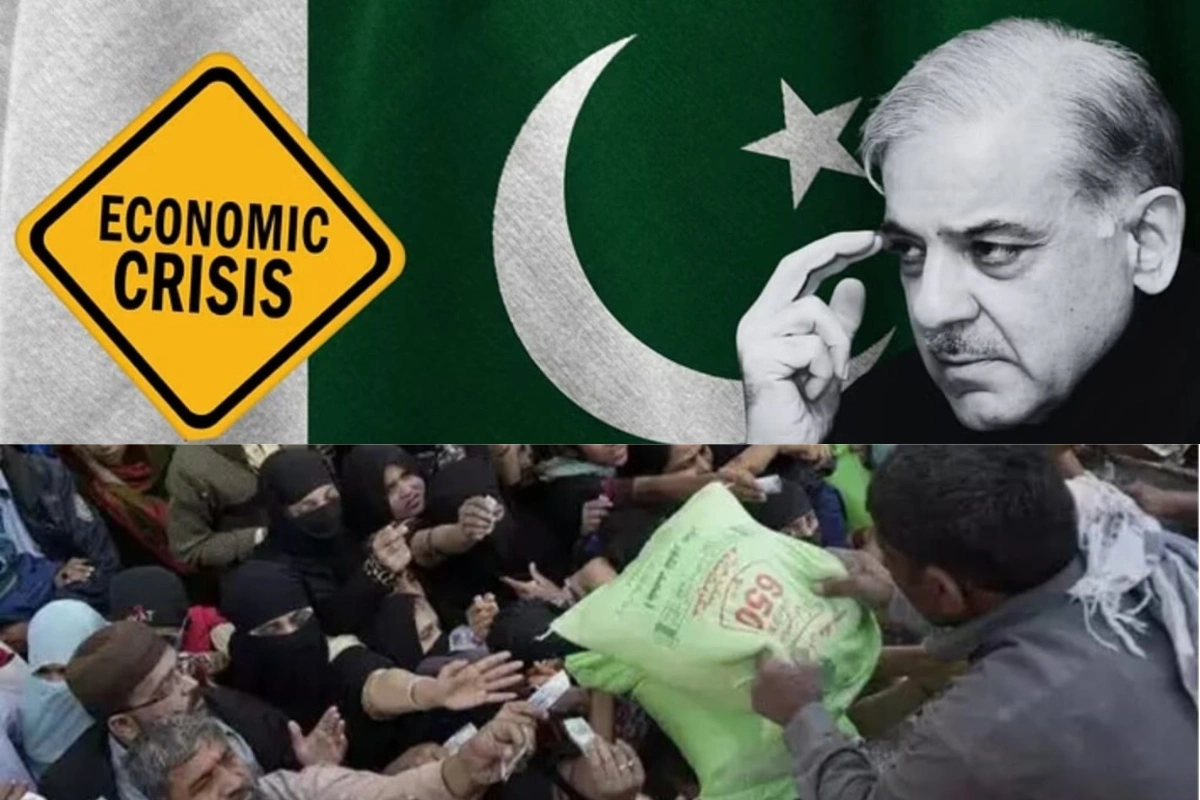

Pakistan Economic Crisis: The economic history of Pakistan reads more like a pathological addiction to absolute crisis. The terror state since 1958 has lurched badly from one bailout to another with each one supposed and claimed to be the last.

In a recent video, Pakistani Prime Minister Shehbaz Sharif accepted that the foreign loan dependence of Pakistan has now become a humiliation. The country presently begs before Beijing, Riyadh, Abu Dhabi and Doha to prevent a complete collapse of its balance of payments – promising fresh investments, extending oil credit and rolling over deposits.

A staggering 22 interventions by the International Monetary Fund (IMF) says it all. No wonder, begging in the guise of political diplomacy and brotherhood has become the primary economic life support of the Asian nation.

According to estimates, a staggering 45 percent of the country’s population lives below the poverty line. Surprisingly, this level has almost doubled since 2018. The unemployment rate of the country stands at approximately 7.1 percent and more than 8 million of the nation’s population is jobless.

Mounting External Debt Of Pakistan

Over the last 15 years, Pakistan has extracted $28.79 billion from ally China, $9.16 billion from Saudi Arabia and $3 billion from Qatar. Interestingly, a significant majority of this “bailout” money has possibly reached the private hands and pockets of Pakistani social elites and army.

On top of that, these loans with shark-tank teeth would be tough pills for Pakistan to swallow. The commercial loans of China are featured by a 6 percent interest rate and 4 percent for Saudi help. The country has to service a staggering external debt of $100 billion in the next 4 years, which is approximately 11 times the present forex reserve ($9.4 billion) of the country.

Structural Debt Trap

Tax evasion and corruption cost the Pakistani exchequer a staggering sum of $10 billion every year. Now comes the big challenge – each dollar fled abroad or “stolen” is a dollar that the IMF had to eventually replace with fresh bailout money. Today, the Pakistani system has become a self-perpetuating loop wherein the state continues to stay overly dependent on all forms of external lending, the wealthy people avoid taxation and the shoulders of the ordinary Pakistani mount enormous debt burdens that they did not even incur.

If this is not all, the country allocates $9 billion of its annual budget for defence – 3.2 percent of the country’s GDP. Put differently, Asim Munir is consuming Pakistan’s brunch, breakfast, lunch and dinner while investments in healthcare, public welfare, education and productive infrastructure starve like anything. To sum up, this is nothing but slow-motion, self-induced collapse that would cripple the economy one day or the other.

DON'T MISS

There are many other countless reasons behind crumbling of the Pakistani economy, including but not limited to:

- High debt servicing eating money meant for government expenditure, halting development spending

- Trapped exports in low-value commodities and textiles

- Undermining of democratic accountability due to symbolic approval by Parliament in scrutinizing debt ceilings

- Local industries are failing due to widespread corruption, high utility bills and diversion of country’s resources to China

- Little progress on the recovery of bad loans means capital being locked up, credit shrink and borrowing costs get increased

- Severely high inflation rates making even basic necessities a challenge for the common Pakistani

- A significant increase in forex liquidity issues

- Retaliatory actions by Pakistan Taliban (TTP) and Balochistan Liberation Front

- Breaching Fiscal Responsibility and Debt Limitation Act, 2005 thresholds without sufficient corrective measures

Increase in Public Debt

The public debt of Pakistan has crossed Rs. 80.5 trillion, which amounts to a whopping 70.7 percent of gross domestic product (GDP). In just one year, the individual debt burden on each Pakistani citizen has now translated into Rs. 333,000.

However, a deeper and vicious legal and constitutional crisis lies beyond just the financial numbers.

India-EU FTA Trade Deal: Implications For Pakistan

On January 30, Pakistan remarked it is examining the possible consequences of the India-EU FTA deal. Pakistani analysts and exporters believe that this Indian deal could end up leaving their country far less competitive than ever in its second-largest export market.

This could possibly counter the long-standing advantage of Islamabad under the Generalized Scheme of Preferences Plus (GSP+) of EU. Interestingly, the scheme expires in December next year.

The 27-member bloc of European Union accounts for nearly 40 percent of $7 billion of the textile shipments of the terror state each year, employing approximately 15-25 million Pakistanis.

The crisis of Pakistan is structural and no longer cyclical. Now comes the big question – how long can begging, rhetoric against India, terrorism and corruption go on?