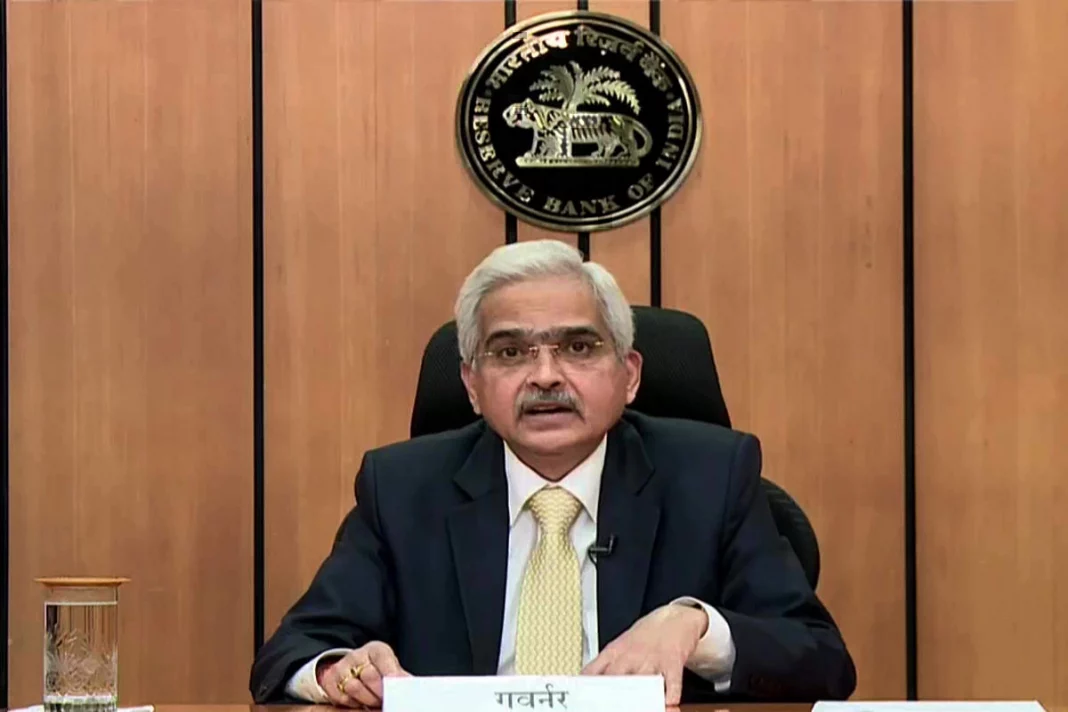

The Insolvency and Bankruptcy Code (IBC) should not be viewed as a recovery tool but rather as a way to bring resolution in a time-bound manner, according to Reserve Bank of India (RBI) Governor Shaktikanta Das on Wednesday.

RBI Governor says “IBC should not be seen as recovery mechanism, but way to bring time bound resolution

IBC should not be viewed as a recovery tool, said Das, who was speaking at a gathering in Mumbai. It must be viewed in the appropriate light. Recovery is crucial. Making an appropriate reference to IBC is crucial. The current focus is on early stress detection and prompt stress management.

IBC was introduced in 2016 to fast track resolution of Banks Non Performing Assets

In order to expedite the resolution of banks’ non-performing assets, the IBC was created in 2016. (NPAs). The IBC’s corporate insolvency resolution process provisions went into force in December 2016. The goal was to ensure fair negotiations between the borrower and creditors while speeding up and simplifying the bankruptcy process.

According to the data, IBC cases have had a dismal recovery rate. As of March-end, the number of distressed enterprises liquidated under the bankruptcy law surpassed those saved, according to data made public by the Insolvency and Bankruptcy Board of India (IBBI).

According to IBBI data, 47% of corporate insolvency operations between December 2016 and March 2022 resulted in liquidation, compared to 14% that resulted in a resolution plan.

Only 3,406 of the 5,258 corporate insolvency cases that were started under the legislation up until March had been resolved. Up to 1,609 of the closed cases have resulted in a liquidation order, while 480 have seen resolution proposals approved. Furthermore, only 457 cases had produced resolution plans as of December 2021.

The governor also emphasised that while the country will see a number of states hold elections in the coming months and the major one, the Lok Sabha election, in 2024, elections were not given priority when formulating the monetary policy.

He claimed that in addressing the problem of inflation, the government and the RBI had a “coordinated strategy.” “One thing I can be clear about (is) the fact that elections are approaching is not at all a factor for monetary policy making,” Das said, adding that the goal of the strategy was to reduce inflation.

Also Read: US govt paid to censor data from public on platforms: Musk

Keep watching our YouTube Channel ‘DNP INDIA’. Also, please subscribe and follow us on FACEBOOK, INSTAGRAM, and TWITTER