The recent announcement of withdrawal of ₹2000 notes by RBI instantly reminds us of the great Indian demonetization 2016. Before you could go back to memory lane, they scramble to save accumulated currency notes. Alas, the dumfounded public does not remember withdrawing any ₹2000 note from the ATM or using in transaction lately. For all practical purposes, this note has disappeared from public view except occasional appearance in media after the CBI or ED raids. It is safe to assume that the RBI announcement affects a miniscule population.

The announcement ensued chaos and confusion and allowed vague and outlandish propositions and memes to build up. Banks interpreted circular differently leading to media frenzy which belittles standing of central bank. Doing away with know your customer (KYC) norms puts the RBI and banks in poor light especially in purported fight against black money. What the RBI governor termed as currency management has lost perception battle among public.

Post demonetization, the RBI introduced ₹2000 notes as a stop gap arrangement. That means sooner or later ₹2000 notes would have been withdrawn. In the ongoing withdrawal, smaller denomination notes are replacing ₹2000 notes keeping overall money supply intact. At the same time, the RBI has given time till the end of September for exchange or deposit and this note will continue to remain a legal tender afterwards. Difficult to find a more friendly central bank.

The early noise about black money or illegal wealth has faded into obscurity. The RBI has abstained from making any such claims. In fact, there is a negligible or small impact on black money. The announcement is most likely helping black money turn into white through unofficial amnesty scheme. On a lighter note, using a corollary from physics, the force of RBI announcement applied on highest denomination currency notes sitting idle in safe makes it move out in the circulation or banking system. The resultant movement or velocity contributes to the white and formal economy although to a limited extent.

Individual, group or business accumulate ₹2000 notes or cash primarily for evading tax or engaging in illegal transactions. This move is forcing them to part with notes with minimum inconvenience. Marginal economic benefits accrue from consumption or redistribution. There are news reports of ₹2000 note being used for buying luxury items, giving salary to employees, paying for petrol, etc. At the same time, by paying a small fee or commission to exchange or deposit notes, unaccounted cash turns white. That is redistribution but again on a very small scale.

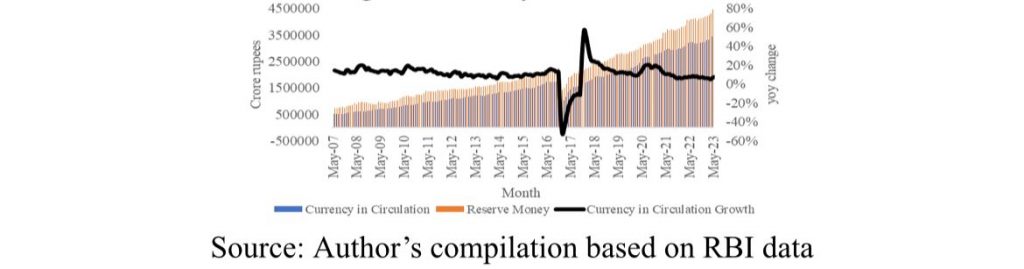

What energy is to the machine, currency is to the economy. As the economy or the GDP grows, the number of transactions and demand for money also increases. From the fundamental of classical economics, money may be neutral in the long run but not in the short run. In this context, increasing the amount of currency in circulation or velocity of money may impact the GDP in the short run if prices are under control. Therefore, the RBI policy of withdrawal or demonetization has impacts on the economy. Citing the cost of printing money and doing such exercise do not hold as the RBI or any modern central bank earns significantly from seignorage.

As per Keynesian theory, people demand money for transactions, precaution and speculation. The demand for black money arises due to weak law enforcement, high tax rate, inequality and corruption. No economy in the world is free from black money, all efforts are aimed at minimizing it. In such a scenario, regulating currency notes may have limited impact on black money if not complemented with other policies. Afterall, there is no permanent solution to black money.

Recent government policies are steering the Indian economy towards formalization and digitalization. The withdrawal announcement adds in the same direction by forcing increased compliance and online transaction. However, if such exercises are known in advance or easy to predict then rational expectations set in to offset intended benefits. Currency or notes are not panacea for ills of the economy but only highlight the status of the economy. There is no major impact on the economy due to ₹2000 note withdrawal. In total, it is a well-managed compliance exercise with net positives.

The upward revision of growth for fiscal year 2023 to 7.2 percent strengthens the faith in the India’s growth story. The growing size of the GST collection in April and May reflects broadening and deepening of formal economy and continued growth of demand. A sizeable credit goes to the RBI for sound monetary policy during pandemic and afterwards. Ignoring the western prescription of printing money, the RBI has targeted inflation better in conjunction with government policies. Amidst global challenges and the election cycle approaching zenith, the anchors are in place and the joyride can wait.

Contributed by Dr Manish Kumar, Assistant Professor, Department of Economics, School of Liberal Arts and Social Sciences, SRM University AP.

Views expressed are personal.

Also read: ‘We reduced lessons on Tipu, Cong not bothered’: Ex-minister

Keep watching our YouTube Channel ‘DNP INDIA’. Also, please subscribe and follow us on FACEBOOK