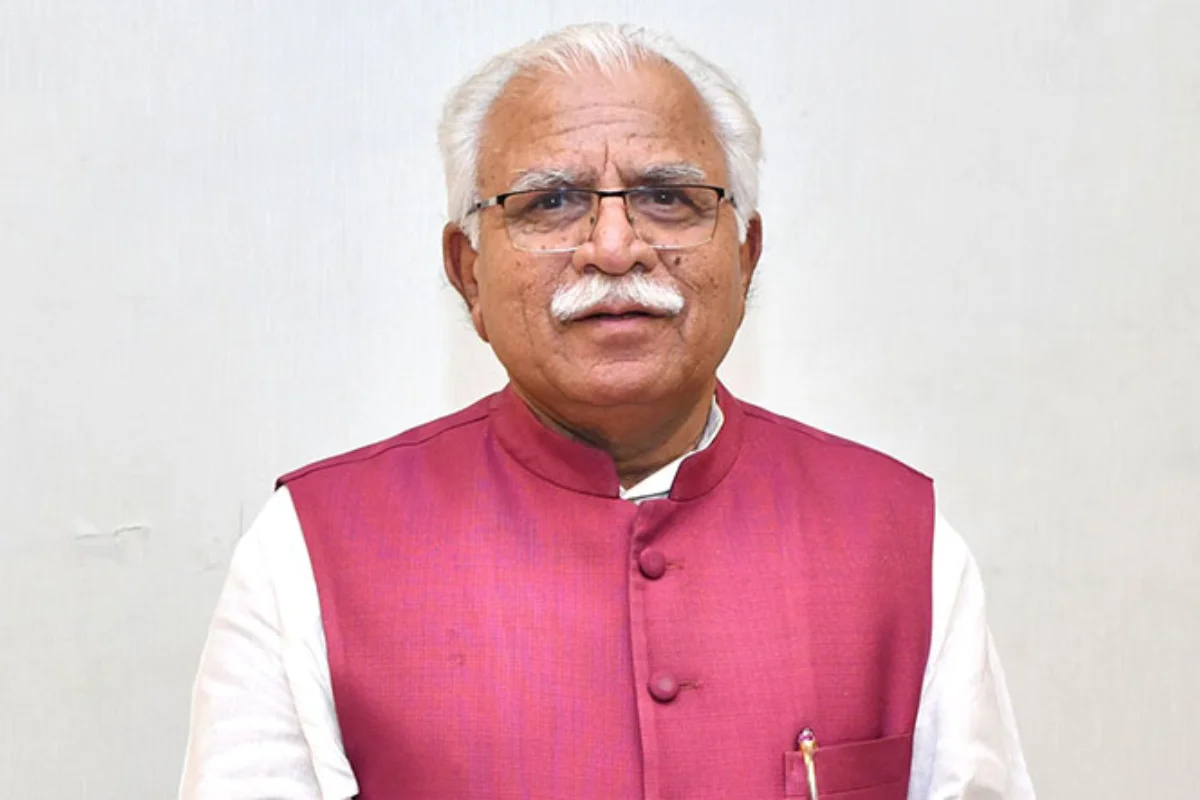

In a significant move addressing a persistent demand, Haryana Chief Minister Manohar Lal Khattar launched the One Time Settlement-2023 (OTS) scheme. This initiative aims to resolve pending tax payments from the pre-GST regime, providing relief to the state’s traders and business community. The scheme, operational from January 1 to March 30, introduces several categories to address various tax scenarios.

Key Highlights of OTS Scheme

- The tax amount is divided into four categories, starting with an undisputed fee category for cases without dispute.

- Taxpayers in this category pay 100% of the amount with no penalties or interest.

- Disputed taxes under ₹50 lakh require taxpayers to pay 30% of the outstanding amount, while those above ₹50 lakh will pay 50%.

- The scheme includes relief from penalties and interest for undisputed taxes assessed by the department where no appeal was made.

- Outstanding amounts due to differences in tax rates are discounted, with taxpayers paying only 30% of the total.

Flexible Instalment Options

- Taxpayers with outstanding amounts below ₹10 lakh must pay the entire sum in one lump sum before March 30.

- Amounts between ₹10 lakh and ₹25 lakh can be paid in two instalments.

- Payments above ₹25 lakh can be spread across three instalments: 40% in the first 90 days, 30% in the next 90 days, and 30% in the final 90 days.

Addressing Outstanding Tax Issues

- The OTS scheme covers outstanding tax issues until June 30, 2017, related to the excise and taxation department.

- Specifically, it resolves concerns related to seven VAT-related acts.

Government’s Commitment and Future Plans

- Chief Minister Khattar announced plans to open a GST training institute in collaboration with HIPA, Gurugram.

- Responding to trader and industry demands, the government aims to establish branches of the GST Tribunal in Gurugram and Hisar.

Deputy Chief Minister’s Perspective

- Deputy Chief Minister Dushyant Chautala, who oversees the excise and taxation department, expressed the government’s commitment to the welfare of traders and industrialists.

- Chautala highlighted the state government’s initiatives, including the recent passing of a bill providing exemptions in outstanding tax cases until June 30, 2017.

Keep watching our YouTube Channel ‘DNP INDIA’. Also, please subscribe and follow us on FACEBOOK, INSTAGRAM, and TWITTER