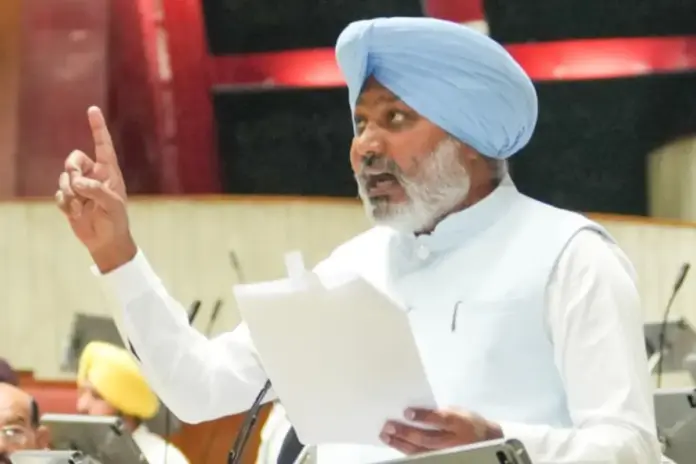

Punjab Chief Minister Bhagwant Singh Mann on Monday said that Punjab is witnessing a decisive shift from decades of political exploitation to an era of development, education reform and welfare-driven governance, asserting that the people of the state will once again use the ‘jhaadu’ to wipe out Congress and the Akali Dal-BJP who ruled Punjab turn by turn while neglecting public welfare.

Addressing a gathering in Qadian in border district Gurdaspur after laying the foundation stone for the renovation of 237 rural link roads worth ₹168.44 crore covering nearly 497 km, the Chief Minister said the Punjab Government is strengthening rural infrastructure, creating jobs and transforming government schools while exposing how earlier regimes prioritised commissions and power politics over the needs of ordinary people.

CM Bhagwant Singh Mann said that while previous governments shut down government schools and neglected border regions, the Punjab Government is building new modern schools, sending teachers abroad for training so that children of Punjab do not have to go abroad for education, attracting ₹1.50 lakh crore investment proposals expected to generate 5.20 lakh jobs, and expanding development to every corner of Punjab, including the decision to make Kahnuwan a Sub Division to bring all key public offices under one roof.

During this, CM Bhagwant Singh Mann said that traditional parties had long misled the people only to satisfy their hunger for power while looting Punjab’s wealth and neglecting the interests of the common man. “The people of Punjab are supreme and they are standing firmly with the Punjab Government, which has taken path-breaking initiatives for the well-being of every section of society,” he said, adding that political parties that ruled Punjab for decades had no agenda except exploiting people and plundering the resources of the state.

Speaking about the situation in the Majha region, CM Bhagwant Singh Mann stated that smugglers who represented the area for years had destroyed generations of Punjab and must now face the verdict of the people. “We eat the biscuits baked in the bakery, whereas these leaders educated in convent schools in the hills consumed gold biscuits smuggled by their fathers,” said the Chief Minister, adding that such leaders have neither ideology nor commitment to serve the common man and are only obsessed with capturing power.

CM Bhagwant Singh Mann said that these royal leaders have nothing in common with ordinary people. “Their cars, their overcoats, their wardrobes and their lifestyles have nothing in common with the lives of ordinary Punjabis,” he said, adding that those who represented the area in the Vidhan Sabha, Rajya Sabha and Lok Sabha ignored development and instead imposed tolls on roads. He also said that the homes of such leaders themselves reflect political opportunism as flags of two different parties can be seen at the same house.

Referring to the internal situation in the Congress party, CM Bhagwant Singh Mann said that every Congress leader wants to become the Chief Minister. “They have more Chief Ministers than ordinary workers,” said the Chief Minister, adding that their top leader recently publicly rebuked them during a rally. “The Congress party is a divided house that will collapse due to its internal infighting,” he said.

CM Bhagwant Singh Mann further said that it is unfortunate that senior Congress leaders who come to unite their party leaders cannot even pronounce their names correctly. “These leaders have no vision for Punjab. Their only aim is to capture power and plunder Punjab’s wealth, but their dreams will never be fulfilled,” said CM Bhagwant Singh Mann, adding that earlier traditional parties waited for their turn to grab power but now the broom has arrived to clean the mess created by them.

Coming down heavily on the Akali leadership, he said that those who cannot even find 11 members to constitute a committee in their own party are dreaming of winning 117 seats in Punjab. He reminded people that such leaders patronised gangsters and allowed drugs to spread among Punjab’s youth by shielding drug smugglers.

“Akali Dal has become a party of political deadwoods who have been rejected by the people time and again,” said CM Bhagwant Singh Mann, adding that although the Akalis may try to misuse religion for political gain, Punjabis will not be misled again.

CM Bhagwant Singh Mann stated that Akali leaders are building castles in the air and trying to mislead people, but Punjabis will never forgive them for their past actions. Referring to claims made by Sukhbir Badal regarding development, CM Bhagwant Singh Mann said that these leaders conveniently ignore sacrilege incidents that occurred during their tenure.

“These people have bruised the psyche of every common man by using religion for their vested interests, which is an unforgivable sin,” asserted CM Bhagwant Singh Mann. He added that the Akali leadership is hand in glove with forces that are inimical to the Sikh Panth and Punjab and that such opportunistic leaders only pursue their personal interests.

CM Bhagwant Singh Mann stated that traditional parties are uncomfortable with the AAP because the Punjab Government has placed the welfare of the common man at the centre of governance. “Earlier the Congress and BJP played friendly matches by enjoying power on a rotation basis, protecting each other’s interests while looting the state,” he said, adding that they treated governance like a game of musical chairs while ordinary people suffered.

CM Bhagwant Singh Mann said that this cycle ended when the AAP entered politics and challenged corruption. “Whenever someone raises their voice against corruption and these entrenched interests, they try to put them behind bars by filing false cases,” he said, adding that beneficiaries of corruption networks attempt to target honest leaders through fabricated charges.

Highlighting the achievements of the Punjab Government, CM Bhagwant Singh Mann said that unprecedented steps have been taken in the last four years to improve the lives of people. “The opposition is not concerned about the prosperity of the people. Their only interest is in capturing power,” he said.

CM Bhagwant Singh Mann said that the Punjab Government is using every rupee of the state exchequer responsibly for public welfare. “More than 90 percent of households in Punjab are receiving free electricity. Farmers are getting power supply during the daytime for irrigation, something that had never happened earlier,” he said.

He also said that while the Union government is selling national assets to a few select friends, the Punjab Government created history by purchasing a private thermal plant and naming it after Sri Guru Amardass ji.

CM Bhagwant Singh Mann said that the Punjab Government has launched the Mukh Mantri Mavaan Dhian Satkar Scheme under which women above 18 years of age from the general category receive ₹1,000 per month and women from Scheduled Caste communities receive ₹1,500 per month as financial assistance.

“For ordinary families, especially the poor, ₹1,000 to ₹1,500 is a significant support. This assistance is a mark of respect for mothers and daughters,” said CM Bhagwant Singh Mann, adding that the happiness on women’s faces after receiving this support gives him immense satisfaction.

Speaking about education reforms, CM Bhagwant Singh Mann said that teachers and principals from Punjab Government schools are being sent abroad to upgrade their skills and teaching methods. “Punjab has ranked first in the National Achievement Survey conducted by the Government of India, surpassing even Kerala,” said Bhagwant Singh Mann.

He further said that students are now receiving specialised coaching for competitive examinations such as Armed Forces preparation, NEET, JEE, CLAT and NIFT. “Around 300 students from Schools of Eminence and other government schools have qualified for JEE Mains, JEE Advanced and NEET examinations,” said the Chief Minister.

CM Bhagwant Singh Mann said that farmers are now receiving electricity during the daytime for irrigation for the first time, which has brought a major change in their lives. He also said that while the Punjab Government is expanding welfare measures for people, the BJP government in Delhi has stopped such facilities after coming to power.

Highlighting the health sector reforms, CM Bhagwant Singh Mann said that the Punjab Government has launched the Mukh Mantri Sehat Yojna, a first-of-its-kind scheme providing cashless medical treatment up to ₹10 lakh for every resident family in Punjab. “Punjab has become the first state in India to provide such comprehensive healthcare coverage to every family,” said the Chief Minister, adding that the scheme significantly reduces the financial burden on people while ensuring quality healthcare services.

During the event, CM Bhagwant Singh Mann also announced several development initiatives for the region. He said that Kahnuwan will be made a Sub Division, a state-of-the-art stadium will be constructed, and the defunct ITI will be made operational again. CM Bhagwant Singh Mann added that the sewerage projects at Qadian and Dhaliwal will be completed in a time-bound manner.

CM Bhagwant Singh Mann further announced that a training centre on the lines of the Maharaja Ranjit Singh Armed Forces Preparatory Academy will be established in the Majha region. He also said that the Punjab Government will take up the issue of reopening the Dhaliwal woollen mill with the Union government.

Reaffirming the Punjab Government’s commitment to economic growth, CM Bhagwant Singh Mann said that major efforts are being made to strengthen industrial infrastructure and attract investment to Punjab. “So far, investment proposals worth ₹1.50 lakh crore have been secured, which will create around 5.20 lakh job opportunities for the youth,” said CM Bhagwant Singh Mann.

Sharing a few snippets from the gathering on X, CM Bhagwant Singh Mann stated: “Today, a major step was taken to accelerate rural development in Qadian constituency of border district Gurdaspur. The foundation stone was laid for a project to renovate 237 rural link roads at a cost of ₹168.44 crore. Under this project, nearly 497 km of roads will be upgraded, significantly strengthening connectivity in rural areas and addressing problems that residents have faced for decades.”

He further stated, “For a long time, the condition of several roads in the region had deteriorated badly, causing serious difficulties for people in their daily travel. Once the project is completed, it will not only improve connectivity in rural areas but also provide significant relief to farmers, traders and students. Previous governments had deprived rural and border areas of development for years, but we are working with sincerity and commitment to ensure that development reaches every corner of Punjab. The government remains fully committed to connecting Punjab’s villages with strong infrastructure, making life easier for people and taking the state to new heights of development.”